FAQ

What is Snowball Finance?

Snowball Finance is a yield optimizer on the Avalanche Network. https://medium.com/snowball-finance/snowball-finance-launce-68554044bdd2

Why should I use Snowball Finance?

Snowball Finance automatically compounds PNG rewards for you multiple times per day, saving on gas and generating higher APY.

How does auto compounding work in Snowball?

Deposit your liquidity provider (LP) tokens into the SnowGlobe with the same token as you. After depositing you will receive S tokens, equivalent to the token pair you deposited. The rewards you receive as a LP are reinvested into the token you deposited. Snowball takes a 10% fee of the rewards you receive as a LP. Compounding happens multiple times per day, depending on the pool size.

Snob tokens received from depositing your S tokens into IceQueen are not compounded.

Snob tokens received from depositing your S tokens into IceQueen are not compounded.

What does Ice Queen do?

You can send the sPGL tokens that you got from the Snowglobe to the Ice Queen. In return you will get our governance token; “snob”.

Who is behind Snowball?

We are currently anon. Snowball was initiated by AbominableSasquatch

How much gas do I save with auto-compounding?

Compound steps: Claim > Swap > Add Liquidity > Deposit

Gas cost of one manual compound: 0.49652 AVAX

Compounds per day/week/year: 6/42/2190

Gas saved per day/week/year: 2.98/20.85/1087.38 AVAX

Gas cost of one manual compound: 0.49652 AVAX

Compounds per day/week/year: 6/42/2190

Gas saved per day/week/year: 2.98/20.85/1087.38 AVAX

What are Snowball (SNOB) tokens?

The snowballs (snob) are our governance tokens. We are currently working on a governance architecture so that you will be able to have a say in the direction that Snowball will take.

How do I earn Snowball (SNOB) tokens?

Earn Snowball tokens by either depositing sPGL tokens or SNOB-AVAX LP tokens into the IceQueen contract

What are the tokenomics?

Max supply:

18 million

Distribution schedule: 1st 200k blocks - 5 Million Snowballs 2nd 200k blocks - 4 Million Snowballs 3rd 200k blocks - 3 Million Snowballs Next 2M blocks - 1 Million Snowballs Next 4M blocks - 1 Million Snowballs Next 6M blocks - 1 Million Snowballs

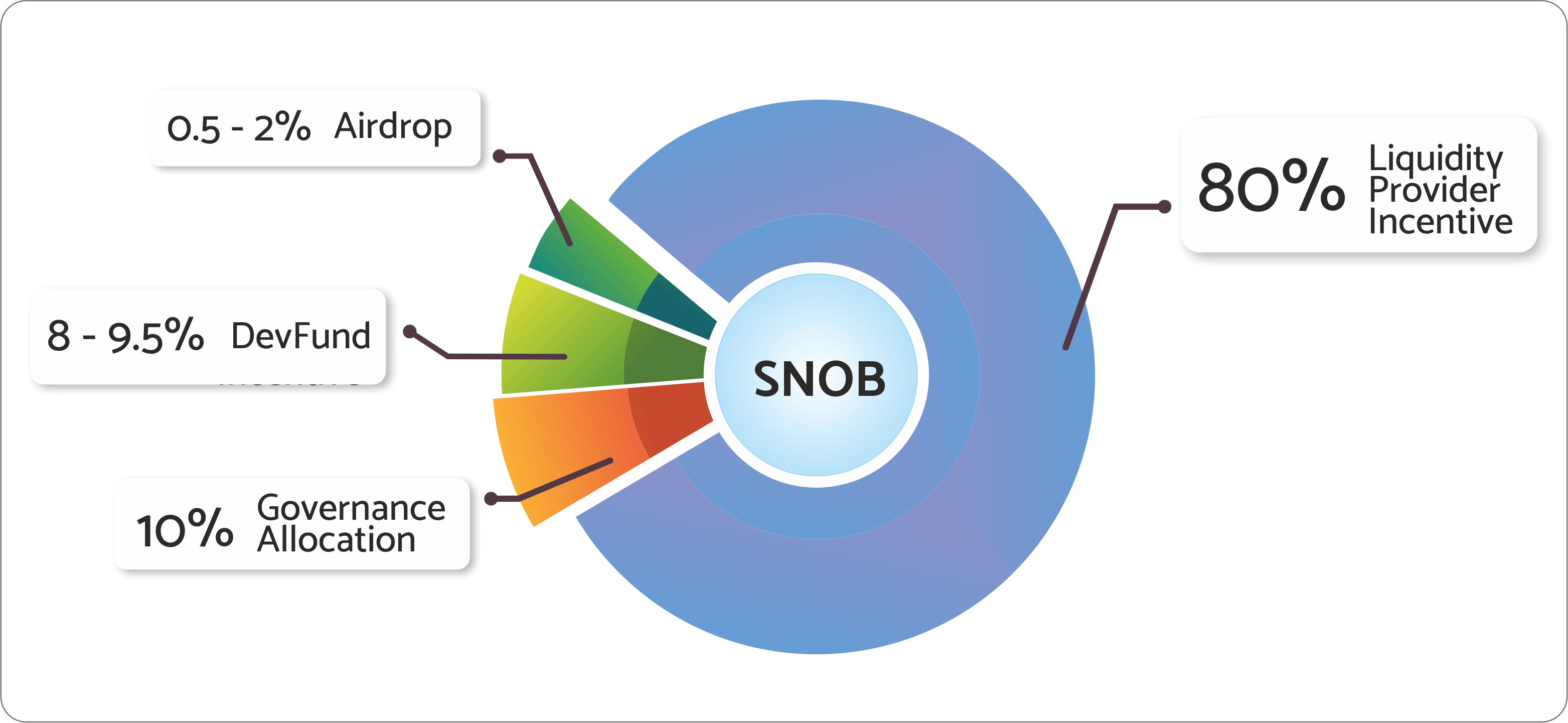

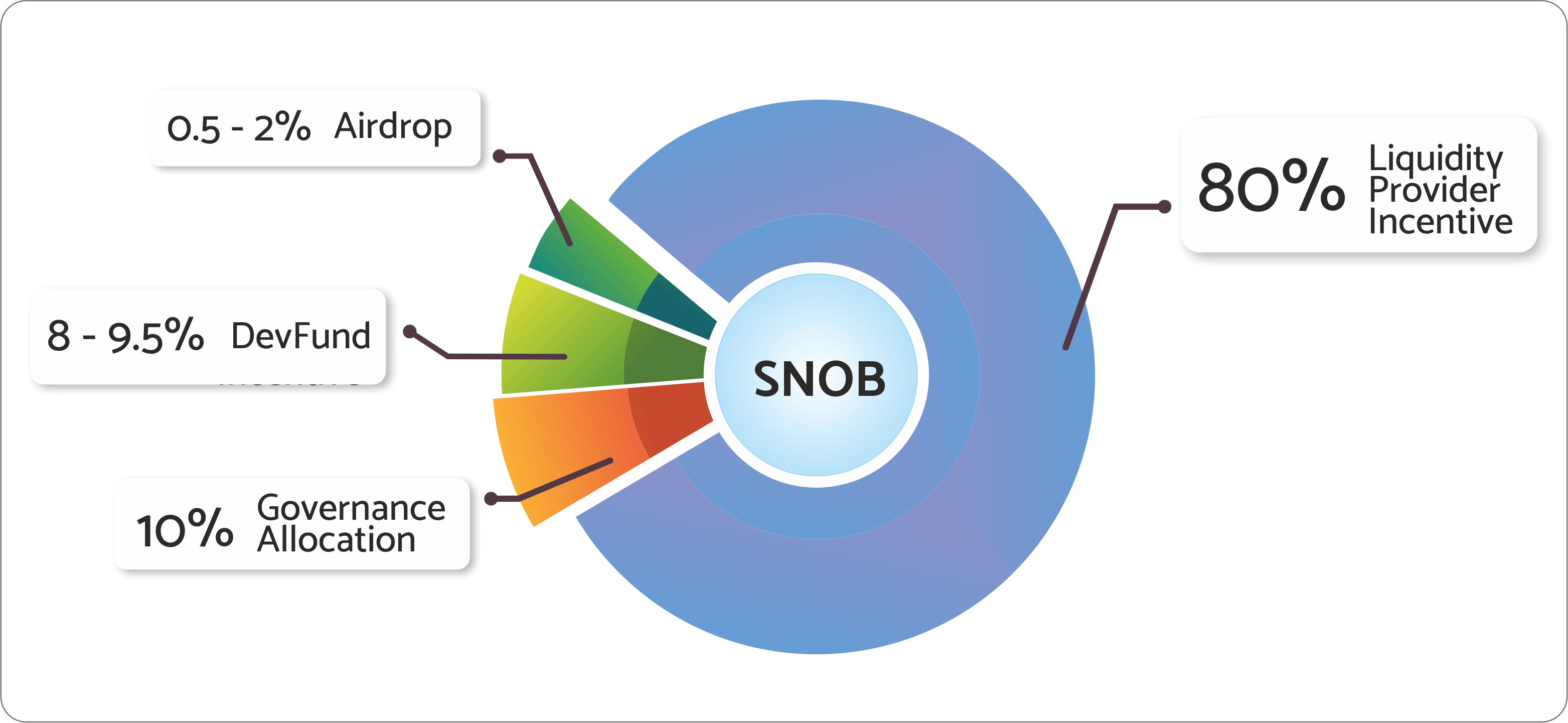

Allocation: 80% Liquidity Provider Incentive 10% Governance Allocation 8–9.5% DevFund 0.5-2% Pickle Finance Community Airdrop*

18 million

Distribution schedule: 1st 200k blocks - 5 Million Snowballs 2nd 200k blocks - 4 Million Snowballs 3rd 200k blocks - 3 Million Snowballs Next 2M blocks - 1 Million Snowballs Next 4M blocks - 1 Million Snowballs Next 6M blocks - 1 Million Snowballs

Allocation: 80% Liquidity Provider Incentive 10% Governance Allocation 8–9.5% DevFund 0.5-2% Pickle Finance Community Airdrop*

Is this tool safe to use?

Snowball is a fork of pickle.finance which is audited. Snowball is currently not audited and the plan is to do an audit of the contracts. You can make your own judgement whether you trust the contracts by having a look on Github.

The source of this website is also on github: https://github.com/best-coder-NA/vfat-tools

That said, Snowball is an experimental protocol. Please only deposit funds you are okay losing. Yield farming in itself has inherent risks; do your own research.

The source of this website is also on github: https://github.com/best-coder-NA/vfat-tools

That said, Snowball is an experimental protocol. Please only deposit funds you are okay losing. Yield farming in itself has inherent risks; do your own research.

Why can't I connect my wallet?

Please ensure you have Metamask installed and are configured to use the Avalance Network. https://tradingtoolcrypto.medium.com/how-to-use-metamask-with-avalanche-avax-e5db94d749b

How do you calculate APR and APY?

For APR we use the same logic as https://vfat.tools/avax/png/.

It takes price of the two tokens in a pair, price of PNG, and PNG emissions rates from Pangolin Exchange into factor.

For APY we use the standard formula A = P(1 + r/n)nt Try it yourself here: https://www.calculatorsoup.com/calculators/financial/compound-interest-calculator.php

It takes price of the two tokens in a pair, price of PNG, and PNG emissions rates from Pangolin Exchange into factor.

For APY we use the standard formula A = P(1 + r/n)nt Try it yourself here: https://www.calculatorsoup.com/calculators/financial/compound-interest-calculator.php